Hollowing out of the Middle Class – Mergers & Acquisitions A Primary Cause

Hollowing out of the Middle Class – Mergers & Acquisitions A Primary Cause

Summary

Everyone intuitively knows the demise of the quality of life and financial independence of the working middle class during the past few decades. Fewer though are the ones that point out what happened and why. And just exactly how did the rich get richer while the working class got demoted to the working poor?

Like many things not one simple answer but one common cause is a tax system controlled by and for the rich who buy off elected representatives against the best interests of their constituents. One aspect of the corrupted tax system that rewards wealth at the expense of the working class involves Mergers and Acquisitions a favorite tool for the corporate fascist regime that controls government.

Issue

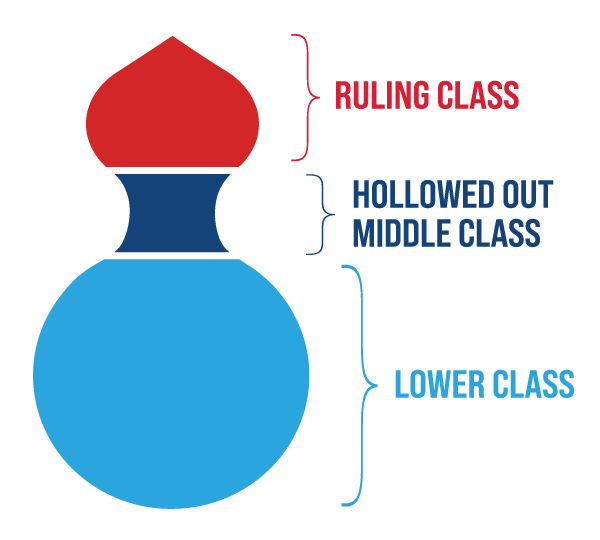

Real disposable income as adjusted for both inflation and taxation has declined for the working class over the past few decades while the upper class disproportionately has gained in wealth. Once the majority, the healthy and vibrant middle class has been hollowed out making a two-class system with an upper class of wealth and a lower class of working poor. The cause for this is multifaceted but a primary component is tax rate manipulation that rewards wealth while punishing the working class.

Before talking how the tax scheme was set up lets first discuss how it works to hollow out the middle class. Competition drives greater choice and with it increased level of service and actual employment. The drawback is that it also drives profit margins down and reduces income to shareholders. This is good for the working class but bad if you’re a psychopathic plutocrat that falsely believes all wealth should reside with them. So, the easiest way to increase wealth and profit is to reduce competition. Simply acquire competitors allowing one firm to monopolize the field, drive out costly employees by offshoring work when opportune and increasing those coveted profit margins.

The problem is that it’s very expensive to buy out other companies and some private small business owners are resistant or simply just don’t want to sell. So, what to do? Well, how about create a tax rate scheme that makes it cheaper to buy companies while at the same time punishes small business owners that keep their business but rewards them if they sell out.

So, the corporate fascist government created a two-tier tax system and divided income into two groups with one being called “earned income” and the other being called “passive income”. They then use MoM (Media of Manipulation) to repeatedly message a false narrative to convince all that investors must receive lower tax rates on so called “passive income” or otherwise they won’t invest. Their false implication being that this will hurt the economy and reduce jobs. Anyone paying attention and fully aware knows this not to be true. They may make less profit but will always invest in viable and worthy opportunities.

This two-tier tax scheme makes tax rates incredibly low on passive income at 15% to 20% while

steadily increasing tax rates on earned income to around 40%. So, now a small business owner that

makes a profit has to pay 40% of their profits (more with state taxes) to the government. However, if they sell out to one of the big mega corporations, they get a big pay out based on future profits but they only now have to pay a 15%- 20% tax as the profit from the sale is now considered a capital gain (aka passive income). Owners may resist the temptation to sell but it is financially detrimental to do so. So away we go with the monopolization of America with steady absorption of small innovative business into the control of the few mega corporations. Corporate fascism through government then adds a layer of destructive, burdensome and time-consuming regulations to the tax scheme and the deliberate removal of competing small business is accomplished. If that still isn’t enough, panic everyone with a virus and destroy the rest of the small businesses through selective governance.

Solution

So how do we fix this and begin restoring real income to the working class and rewarding privately

owned small businesses while kicking the plutocracy in the wallet? Simply by amending our constitution to replace the sixteenth amendment with the Equal Tax Amendment that aligns tax rates and protects tax rates from manipulation. Include other reforms such as Truth in Taxation Reporting so the public can see real tax rates and combine with regulatory reform to simplify business operations including litigation reform and making employing Americans less expensive.

Grant of Copyright Permissions* Everyone has my permission to republish, share, use and translate this work as long as reproduced in its entirety free of charge. * The Media of Manipulation (MoM) and other Platforms for the unfair control, abuse and manipulation of people excluded.